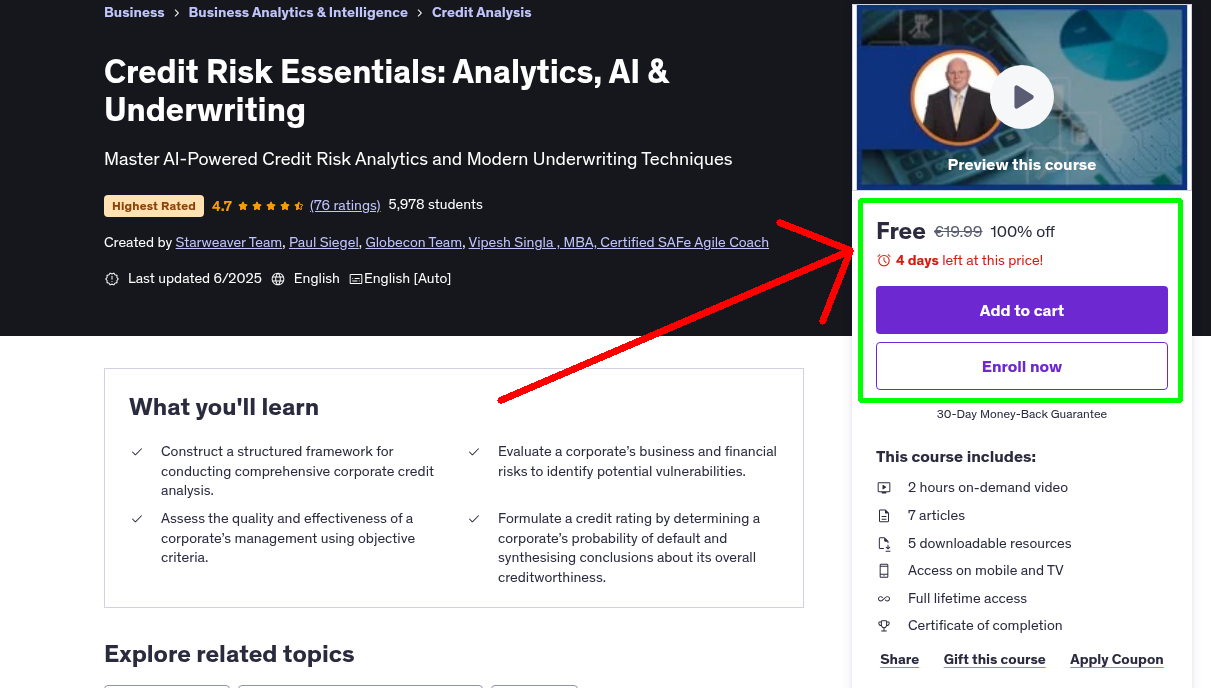

What You'll Learn

- Construct a structured framework for conducting comprehensive corporate credit analysis.

- Evaluate a corporate’s business and financial risks to identify potential vulnerabilities.

- Assess the quality and effectiveness of a corporate’s management using objective criteria.

- Formulate a credit rating by determining a corporate’s probability of default and synthesising conclusions about its overall creditworthiness.

Requirements

- A solid understanding of the structure and format of financial statements is essential, along with knowledge of the contents and structure of a typical set of audited accounts. Additionally, familiarity with the basic mechanics of accounting and the process of recording financial transactions is required.

Who This Course is For

- This course is ideal for graduate entrants in financial institutions as part of their core competency training, as well as for corporate credit and risk analysts, credit controllers, and credit underwriters. It also benefits relationship managers who require a fundamental understanding of the credit strengths and needs of their existing and potential clients, along with investment analysts seeking to deepen their insight into credit evaluation.

Your Instructor

Starweaver Team

Education you can bank on®

4.5 Instructor Rating

47,334 Reviews

340,007 Students

92 Courses

Never Miss a Coupon!

Subscribe to our newsletter to get daily updates on the latest free courses.