What You'll Learn

- Introduction to Business Mergers & Acquisitions

- Planning

- Financial Planning

- Commercial Analysis

- Legal, IT, InfoSec

- Additional focuses

- Administrating

Requirements

- For a better learning experience, we suggest you to use a laptop / mobile phone / pen and paper for taking notes, highlighting important points, and making summaries to reinforce your learning.

Who This Course is For

- No special requirements. A course for anyone who wants to build career in management

- What are Mergers and Acquisitions (M&A)? Merger: Two companies of relatively similar size combine forces to create a new, single entity. This is often a move for market expansion or gaining a competitive edge. Acquisition: One company purchases a majority stake or all of another company. The acquiring company gains control of the acquired company's assets and operations. This can be done to enter new markets, eliminate competition, or gain new technology resources.

- Key Pitfalls in M&A Culture Clash: Combining distinct company cultures can lead to employee conflicts, low morale, and a decline in productivity. Overpaying: Enthusiasm can lead companies to overpay for an acquisition, resulting in financial losses down the line. Poor Integration: Failure to smoothly integrate systems, processes, and teams creates operational chaos and hinders the potential of the combined entity. Lack of Due Diligence: Insufficient research about the target company's financial health, legal standing, or market position might expose hidden liabilities and risks. Loss of Focus: The complexity of the M&A process can distract from core business operations, leading to neglected customers or missed opportunities.

- Why is Learning About M&A Important for Companies and Managers? Strategic Growth: M&A can be a powerful tool to expand into new markets, acquire new technologies, eliminate competitors, or increase market share significantly. Responding to Market Changes Companies must adapt to industry shifts. An M&A strategy can be vital for staying ahead of the competition or even surviving. Leadership Development: M&A success relies heavily on the ability of managers to navigate complexity, integrate teams, and make crucial decisions under pressure.

- How Can M&A Skills Support Career Development? Increased Demand: As M&A activity continues to be prevalent, professionals with these skills are highly sought after by companies, investment banks, and consulting firms. Leadership Opportunities: M&A skills signal strategic thinking, problem-solving abilities, and a talent for execution – all assets for leadership roles. Broader Skillset: M&A involves exposure to various aspects of business such as finance, valuation, negotiation, and legal, thus developing a more versatile skillset. Higher Compensation: M&A professionals often command higher salaries due to their specialized knowledge and in-demand skillsets.

Your Instructor

MTF Institute of Management, Technology and Finance

Institute of Management, Technology and Finance

4.3 Instructor Rating

97,375 Reviews

942,691 Students

274 Courses

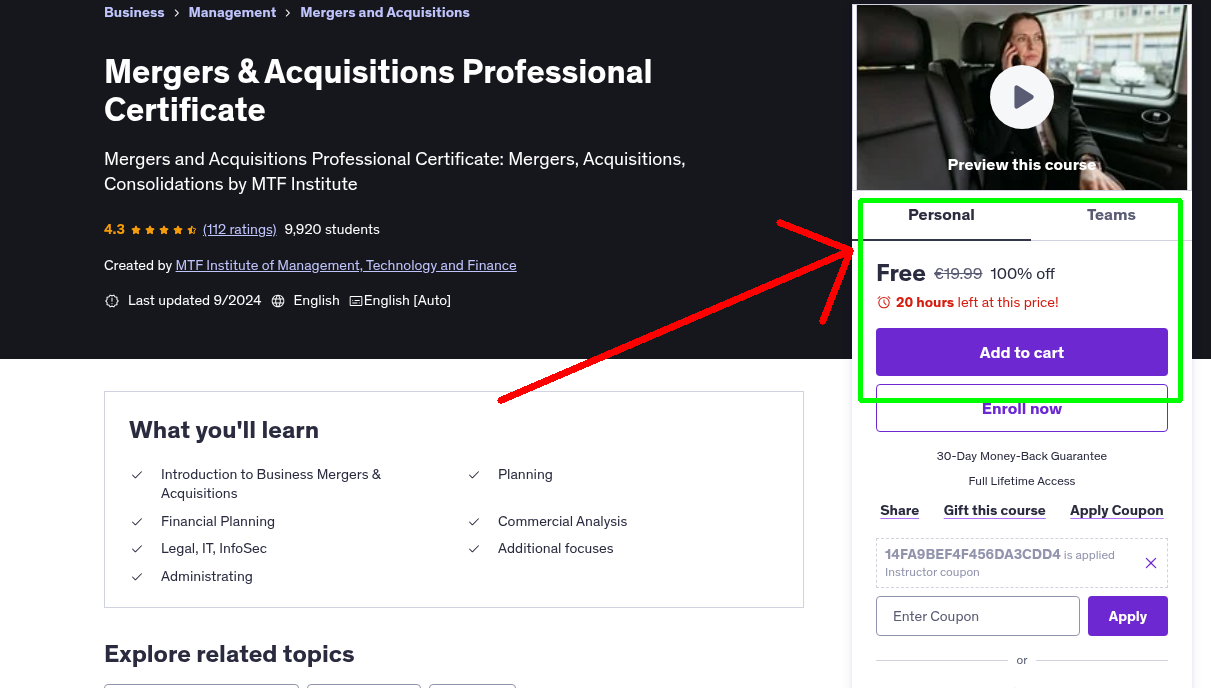

Never Miss a Coupon!

Subscribe to our newsletter to get daily updates on the latest free courses.