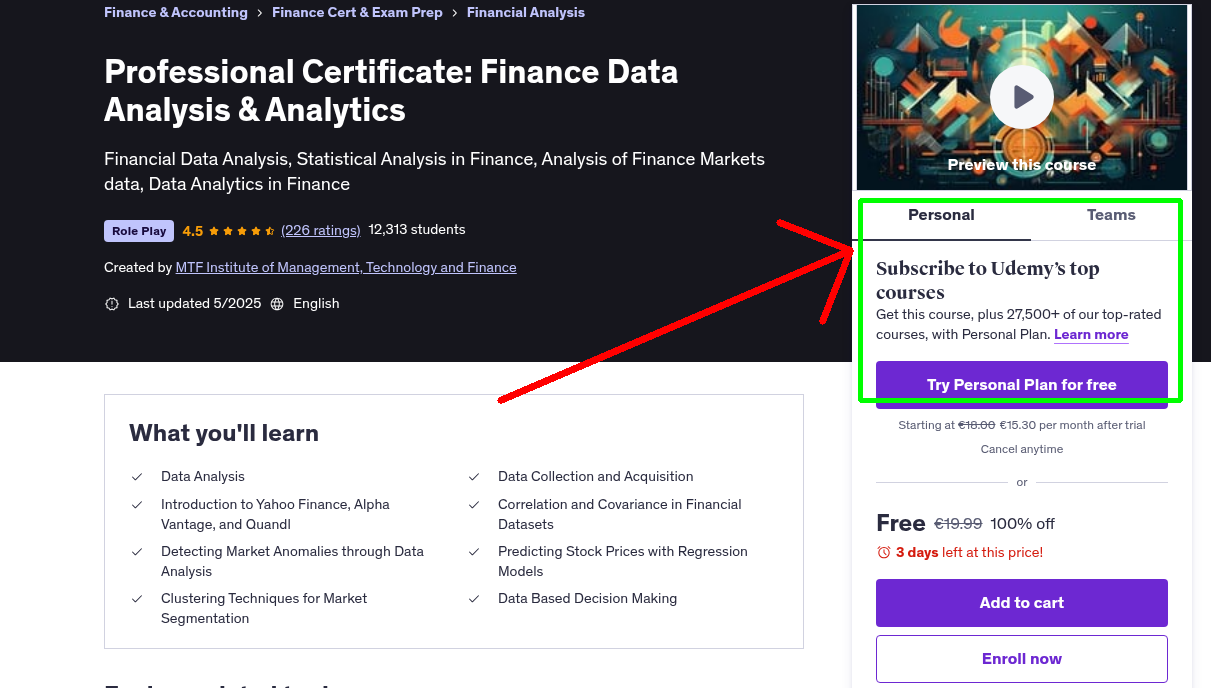

What You'll Learn

- Data Analysis

- Data Collection and Acquisition

- Introduction to Yahoo Finance, Alpha Vantage, and Quandl

- Correlation and Covariance in Financial Datasets

- Detecting Market Anomalies through Data Analysis

- Predicting Stock Prices with Regression Models

- Clustering Techniques for Market Segmentation

- Data Based Decision Making

Requirements

- For a better learning experience, we suggest you to use a laptop / mobile phone / pen and paper for taking notes, highlighting important points, and making summaries to reinforce your learning.

Who This Course is For

- No special requirements. A course for anyone who wants to build career in business and Data Analysis

- This comprehensive professional certificate program equips you with the essential skills and knowledge to excel in the rapidly evolving field of finance data analysis and analytics. From foundational data analysis techniques to advanced financial modeling and decision-making, this course provides a robust learning experience through theoretical concepts and hands-on practical exercises.

- Key Learning Outcomes: Master Core Data Analysis Skills: Learn the fundamentals of data analysis, including data collection, cleaning, preparation, exploratory data analysis (EDA), statistical analysis, and data visualization. Develop Proficiency in Essential Tools: Gain hands-on experience with industry-standard tools like Excel, SQL, Python, R, and Tableau for data manipulation, analysis, and visualization. Understand Data-Based Decision Making (DBDM): Explore the principles and applications of DBDM, including descriptive, diagnostic, predictive, and prescriptive analytics. Specialize in Financial Data Analysis: Delve into the specifics of financial data, including its types, sources, and analysis techniques. Apply Financial Modeling & Forecasting: Learn to build financial models, perform time-series forecasting, and utilize machine learning for financial prediction. Manage Financial Risk & Portfolio Optimization: Understand risk and return concepts, apply Modern Portfolio Theory (MPT), and optimize portfolios using Python and Monte Carlo simulations. Acquire SQL Skills for Financial Data Retrieval: Master SQL for extracting, manipulating, and analyzing financial data from databases. Build a Strong Data Analyst Portfolio: Learn to showcase your skills and experience to potential employers. Navigate the Job Market: Gain insights into career development and current job market trends in data analysis and finance. Understand Data Privacy and Ethics: Learn about the importance of ethical data handling and privacy considerations.

- Course Structure: The course is divided into four main sections, each building upon the previous one: Section 2: Data Analysis (Fundamentals): Covers the core principles of data analysis, including data collection, cleaning, EDA, statistical analysis, data visualization, predictive analytics, and data interpretation. Focuses on building a solid foundation in data analysis methodologies. Includes discussions on data privacy, ethics, and tools for data analysis. Career development and portfolio building are also covered. Section 3: Hands-on Experience: Provides practical experience with essential data analysis tools: Excel, SQL (SQLite), Python, R, and Tableau. Includes hands-on exercises and projects to reinforce learned concepts. Focuses on the practical application of learned theoretical knowledge. Section 4: Data-Based Decision Making (DBDM): Explores the application of data analysis in decision-making processes. Covers various types of analytics (descriptive, diagnostic, predictive, prescriptive) and their role in strategic decision-making. Explores the data driven culture within organizations. Section 12: Data Analysis in Finance (Specialization): Focuses on the specific applications of data analysis within the finance industry. Covers financial data sources, types, and analysis techniques. Explores financial modeling, forecasting, risk management, and portfolio optimization. Includes in depth instruction of the use of tools like python within the finance sector. Includes the use of SQL for financial data retreival.

- Data analysis is the process of collecting, cleaning, and organizing data to uncover patterns, insights, and trends that can help individuals and organizations make informed decisions. It involves examining raw data to find answers to specific questions, identify potential problems, or discover opportunities for improvement. Data analysts transform raw data into actionable insights to help organisations improve operations, strategies, and customer experiences. Core skills include statistical analysis, critical thinking, data visualisation, and proficiency in tools like Excel, SQL, Python, and Tableau.

Your Instructor

MTF Institute of Management, Technology and Finance

Institute of Management, Technology and Finance

4.4 Instructor Rating

101,718 Reviews

970,300 Students

274 Courses

Never Miss a Coupon!

Subscribe to our newsletter to get daily updates on the latest free courses.