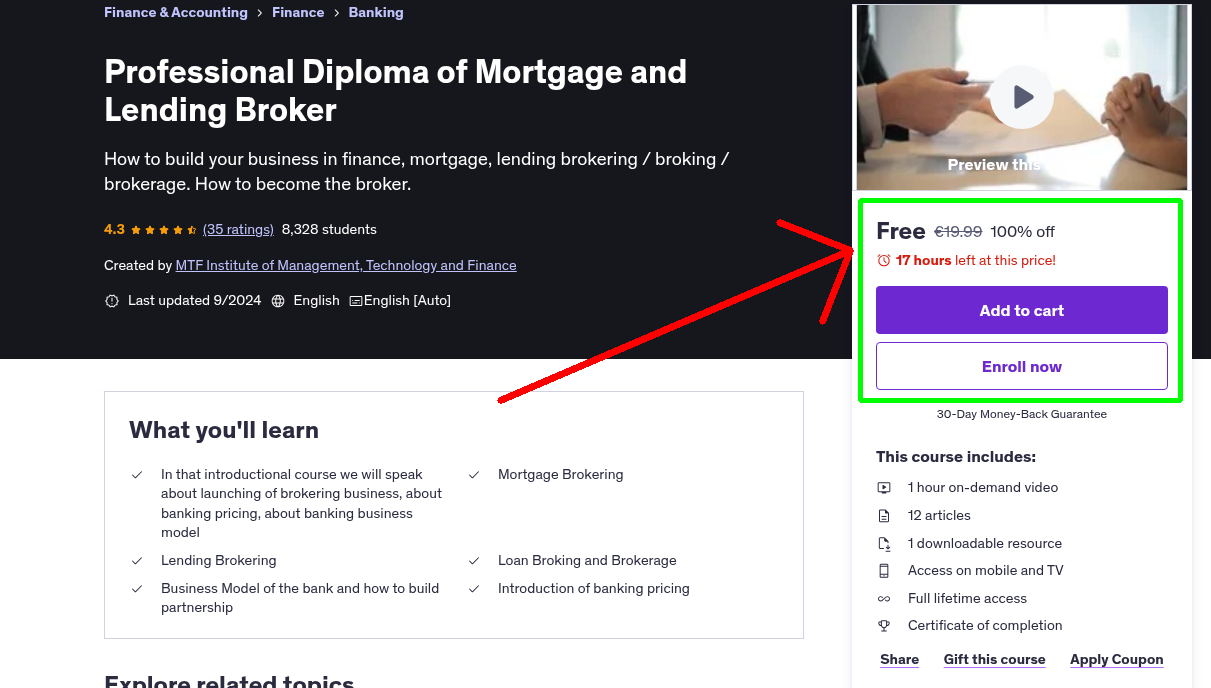

What You'll Learn

- In that introductional course we will speak about launching of brokering business, about banking pricing, about banking business model

- Mortgage Brokering

- Lending Brokering

- Loan Broking and Brokerage

- Business Model of the bank and how to build partnership

- Introduction of banking pricing

Requirements

- For a better learning experience, we suggest you to use a laptop / mobile phone / pen and paper for taking notes, highlighting important points, and making summaries to reinforce your learning.

Who This Course is For

- No special requirements. Course for any who want to build a career in mortgage and lending brokering

- In that introductional course we will speak about launching of brokering business, about banking pricing, about banking business model and how you may build the partnership with bank. Based on your feedback we will extend that course.

- Role of Mortgage and Lending Brokers Intermediary: Brokers act as the bridge between individuals/businesses seeking loans and the financial institutions that provide them. Consultants and Educators: Brokers guide clients through the complicated world of mortgages and loans, explaining different options and their suitability. Advocates: Brokers work to secure the best possible interest rates and terms for their clients, often negotiating on their behalf.

- Typical Functions Assessing Client Needs: Brokers analyze a borrower's financial situation, goals, and credit history. Finding Suitable Lenders: They tap into their network of lenders to match the borrower with institutions that fit their profile. Comparing Options: Brokers present a range of loan products, explaining interest rates, terms, and fees of each. Application Assistance: They help clients gather paperwork and complete the loan application process. Underwriting Support: Brokers often act as liaisons between borrowers and lenders during the underwriting (approval) phase.

- Why Launching a Business in Broking is a Great Idea Strong Market Demand: The mortgage and lending market is complex and constantly evolving, leading to a high need for expert guidance. Entrepreneurial Flexibility: Brokers enjoy the independence of running their own business, setting their hours, and building their clientele. Income Potential: Earning is commission-based, creating a strong link between your effort and financial success. Rewarding Work: Brokers play a crucial role in helping people achieve major goals like homeownership or business expansion.

Your Instructor

MTF Institute of Management, Technology and Finance

Institute of Management, Technology and Finance

4.3 Instructor Rating

97,375 Reviews

943,247 Students

274 Courses

Never Miss a Coupon!

Subscribe to our newsletter to get daily updates on the latest free courses.